In recent decades, venture capital has become increasingly important for start-up financing around the World. VICO, a RISIS core dataset, can help who wants to get information about the determinants of venture capital activity in Europe and its role in supporting the growth of start-ups. Its full documentation is now online on Zenodo space dedicated to RISIS project.

“There is a lot of research in venture capital showing that start-ups financed by venture capital are characterized by high-performance, so venture capital is an important way to stimulate their growth and their professionalization. VICO is a dataset on start-ups and venture capital, in which you can find information on start-ups that received venture capital or angel investment in the period 1998-2014, and we kept track of all information on these start-ups and on investors providing capital for these start-ups”, said Massimilano Guerini, representative of Politecnico di Milano in RISIS project and one of VICO access manager.

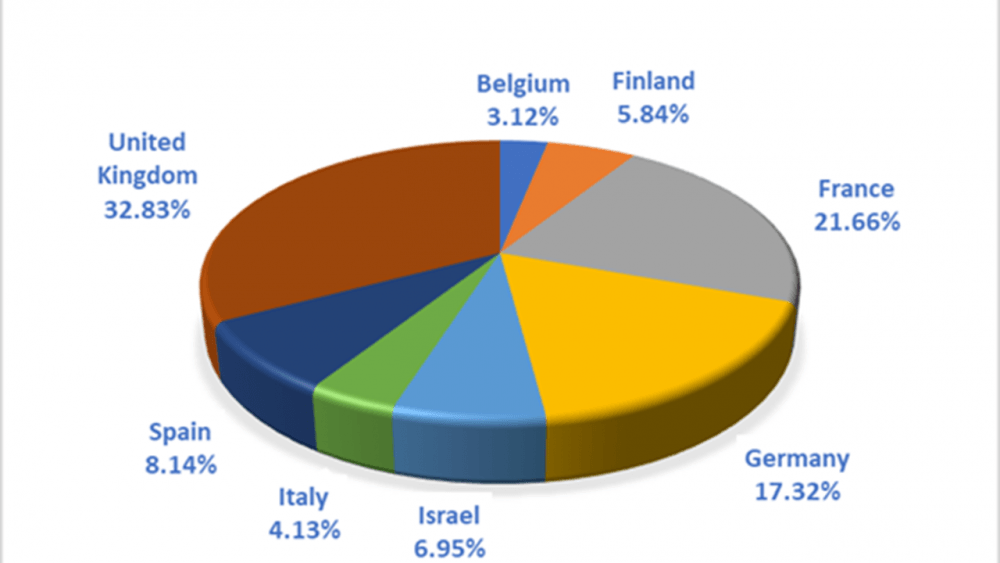

The overall number of companies covered by VICO are 17,863, operating in seven European countries (Belgium, Finland, France, Germany, Italy, Spain, and the United Kingdom) plus Israel.

VICO uniqueness lies in the extent of information gathered, thanks to the combination of multiple secondary data sources. Moreover, it provides basic information on 6,839 distinct investors, of which 5,172 Venture Capitalists (VCs) and 1,551 Business Angels (BAs). Companies and investors have been involved in 28,023 investment deals, for a total of 52,629 observations, as one or more investors can be involved in each single investment round.

“The strength of VICO is the large coverage of venture capital activity in Europe. VICO is essentially a meta-dataset: it means that we combined different sources of information, we cleaned the data in order to be sure that the information are reliable, we double-checked all data and now we think we have a dataset covering most of venture capital activity in Europe. As we combined different kind on information, now we have information on investors, of start-ups, on the economic performance of these start-ups: we are able to evaluate a start-up profitability, growth-rates, when this start-up has been acquired, so we have a large choice of performance measures that can be used for research activity”, goes on Guerini.

During the RISIS1 before and, now, in RISIS2 project, the main aim of the updating and enlarging activities is to create a unique data infrastructure with a substantial coverage of VC activity in Europe:

“We are now working for extending the temporal coverage of the dataset, tracking information of more recent investments, investors and start-ups, to better characterize the different type of investors, such as corporations in venture capital and crowdfunding, an important phenomenon and research topic to be investigated”, concludes Guerini.

The full documentation provides also information on variables and indicators, quality and accuracy of data, and useful technical specifications. For the most interested, there is the opportunity to access the data and to interact with researchers of POLIMI, which will provide advice and customized support.